Tax season is here. How do you feel? Everything’s under control? Stressed? Overwhelmed? In procrastination mode?

Do you file your taxes understanding what you are doing? Or do you just cross your fingers and hope that TurboTax is right?

If you need help, do you know when to ask and who to ask?

Getting your financial team in place can help you feel more confident in your tax reporting and can help avoid costly mistakes.

If you think you might need someone to help with your taxes, but you don’t know who or when to ask, keep reading!

Here we explain the difference between what Certified Public Accountants and CERTIFIED FINANCIAL PLANNER™ professionals actually do when it comes to taxes, so you know who and why you might need one (or both!)

And if you need help understanding your tax documents and what they all mean click here, we give you a summary of all the forms you might need.

Certified Public Accountant (CPA)

More often than not, tax preparation is backward looking. CPAs report what happened in the past.

Their main goal is to use their knowledge of the existing tax law to help minimize your tax bill at the end of the year. They help you take advantage of tax credits and deductions as they apply to your situation.

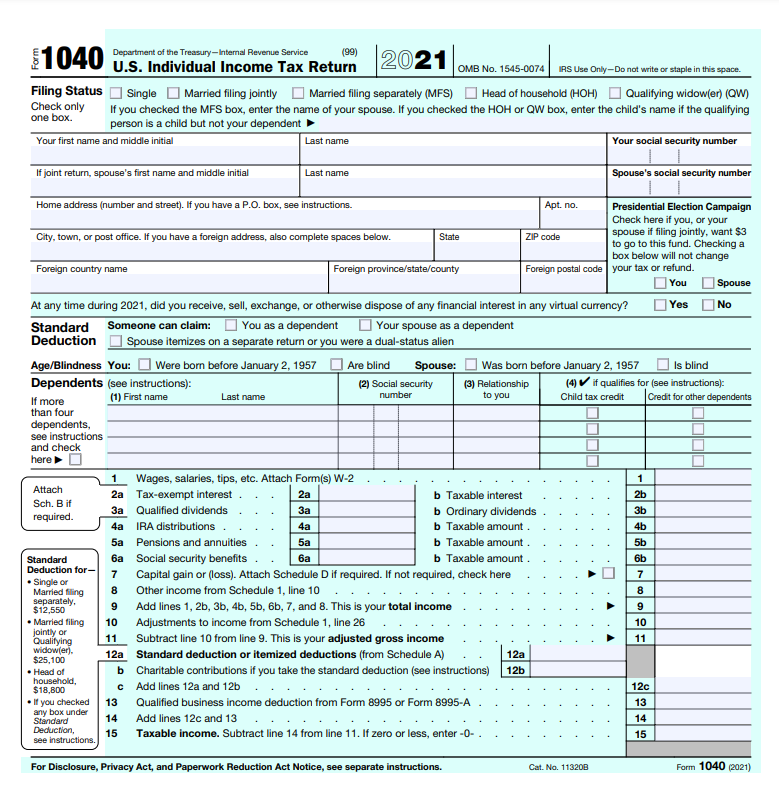

When you work with a CPA, they send you a tax organizer to complete, which asks questions about your life over the last year. The aim is to identify potential tax implications based on what happened. Armed with your answers to those questions, they can request more documentation from you, like tax forms, receipts, etc to build out a detailed picture of your income and tax liability for the year. The “picture” they draw is summarized by the 1040 tax form (see below).

CPAs use very robust software programs that run your situation against potential credits and deductions to see which ones are applied to you. Their software is intended to be very specific to the current tax year and goes down to exact dollar amounts.

When to Hire a CPA:

Hiring a CPA can be a year-over-year decision. Most people hire a CPA in the Fall as they approach year-end. At that point, you can decide how comfortable you feel filing your own return or whether it makes sense to outsource (and pay!) a professional for their services.

It’s true that some tax years might be pretty straightforward, so you may not need to pay for tax preparation services. If you’ve worked with a tax professional in the past and the current year is pretty similar to previous years, maybe you feel comfortable filing your own tax return using TurboTax, or just hiring a tax preparer at H&R Block to save on time.

That being said, it might be worth considering hiring a CPA if:

- You’ve never worked with one before. It’s a good idea to have a baseline for what your normal tax return should look like.

- The tax year looks significantly different from previous years due to big life changes. For example, you have a baby, you have a major health change, you get divorced, or there is a death in your family, just to name a few.

- You have added complexity. Some examples of “complexity” include having actively or passively managed rental property, being a business owner, or you receive equity compensation from your employer. Again, these are just a few examples of what makes a tax situation more complex.

Our experience has shown that there are benefits to having a professional look at your tax situation at least once. That’s because it’s common for people who do their own tax returns to misreport or omit relevant information. Or they may miss big tax savings opportunities because they didn’t know of different ways that they could save or report expenses. Or worse, they may be subject to a penalty because they missed an important deadline that they didn’t know applied to them.

Certified Financial PlannerTM Professional (CFP®)

CERTIFIED FINANCIAL PLANNERTM Professionals, also known as CFP® Professionals, approach taxes in a very different way than CPAs.

We are forward-looking. Our work is focused on broad strokes – the BIG picture – that take into account many tax years.

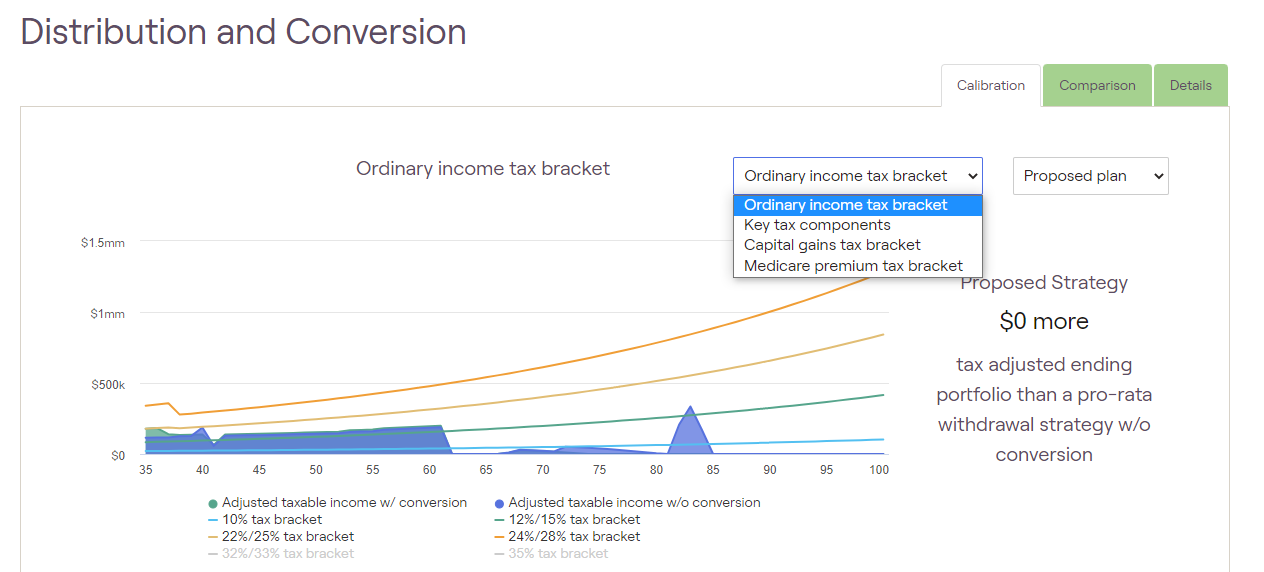

Our software programs are intended to help us identify tax planning strategies by looking at trends in your current and expected future income.

We build out tax-efficient strategies that are focused on meeting your spending, gifting, and legacy goals, while taking into account the taxability of your various investment accounts and assets.

As financial planners, we often say “don’t let the tax tail wag the dog,” which essentially means that we only try to pursue and implement tax strategies that make sense given what you’re trying to achieve with your money. In other words, even if the tax opportunity exists, sometimes it doesn’t make sense given all the other things you’re trying to do.

It’s our job to understand what you are working towards, identify tax strategies that might be possible, and then help you implement those strategies through smart savings, investment, and drawdown.

When to hire a CERTIFIED FINANCIAL PLANNERTM Professional:

People usually start searching for a financial planner if they are in any of the following situations:

- They’re starting to accumulate money and would like help strategizing what to do with it

- They can’t seem to get on top of where their money is going and could use some help organizing a budget

- They have questions like: Can or should I buy a house? How am I going to fund college for my kids? What happens if I take a new job? How do I prioritize all my goals and how do I invest or save for them? And our favorite, can I take a sabbatical from work?

It never hurts to research and interview a few financial planners if you find yourself in one of the above situations to see who might be a good fit. The earlier you are able to establish the relationship, the better, since the strategies can have a compounding effect.

If you work with your financial planner on tax planning, the idea is to make it a long-term relationship. You and your financial planner work together over many years. In the first year, you may identify tax opportunities and establish a strategy. Every year after that, you revisit the strategy and update it as life changes or as there are changes to the tax law. The financial planner helps guide you through possibilities, always keeping your “why” for your money as the goal you’re working towards.

How CPAs and CFP® Professionals Work Together

A CPA’s work on previous years’ tax returns can help give your financial planner a general idea of what you have done in the past and identify areas of opportunity – things that maybe you haven’t taken advantage of, but could in the future.

As you get close to the end of each tax year, your CPA can run tax projections for you to help your financial planner know the “guardrails” to work within as part of the implementation of your year-over-year tax strategy.

For example, your CPA can give you an exact “do-not exceed” limit for ordinary income or capital gains generation to make sure you don’t go over certain income thresholds that would otherwise make you ineligible for certain deductions or credits.

When we have authorization to share information back and forth with our clients’ CPAs, it helps both professionals serve the client the best way they can. Oftentimes the financial planner can tell the CPA what happened – what actions did we take, and what tax forms should he or she expect to receive from you when you file your tax return.

We also set up meetings with our clients and their CPAs to go over potential Roth conversions, capital gains generations, plans to distribute from inherited IRAs, and charitable gifting plans.

In those meetings, the CPA can tell us if there are any carry forward losses that we can use to offset capital gains. They can tell us if we should plan for a tax bill after year-end based on current tax withholding. They can tell us how much you can contribute to self-employed retirement plans and whether you will be under the Roth IRA income phaseouts or able to make a deductible IRA contribution.

Together, we can help our clients be SMART about how they save money during their working years and spend money on their goals, including sabbaticals.

There’s a place for both a financial planner and a CPA on your financial team!

Want to know if having a financial planner is the right move for you? Contact us for more info!

Like this article? Make sure to Pin It so you can go back to it later!