Are you thinking of taking a break from work? 6 months, maybe even a year without stepping into the office! Wouldn’t that be a dream?

Maybe you’re thinking it could only be that… just a dream. But you do see other people doing it. You just don’t seem to understand how it’s possible! How could you not work for a year and not just survive but also thrive and travel the world?

Let us tell you…It is very much possible with the right planning!

This is why working with a financial planner on your sabbatical is a great way to make that dream come true!

To better understand what we do with our clients, we’re sharing with you what it looks like to work with a financial planning firm specialized in sabbatical planning – just like us!

Steps to working with a financial planner to plan your sabbatical:

We break our planning process into three phases: getting ready, being away, and returning home. It’s important to look at your sabbatical from a big picture perspective to avoid any unpleasant surprises (like running out of money in the middle of your trip or before you find a new job when you come back!)

Our goal is to make the before, during, and after trip all enjoyable!

Phase 1: Getting Ready

Before going on your sabbatical we schedule onboarding and quarterly meetings where we work with you to identify priorities and overcome any of your fears and hesitations. This is an important phase so you feel ready to make the break when it’s time!

This includes 3 onboarding meetings with your planner. Each meeting has pre-work, including questionnaires, gathering data, and worksheets

What to expect from phase 1?

The outcomes of this “getting ready” phase include:

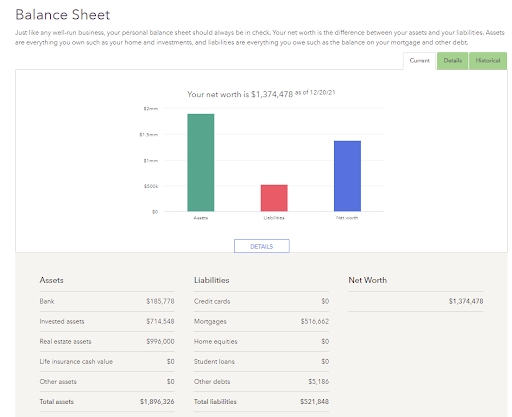

- Baseline financial plan to see your current financial situation in one place

It is crucial to understand the opportunities and gaps of your current financial situation. We don’t have a one-size-fits-all program. We offer you unique and personalized guidance based on your current situation and your aspirations!

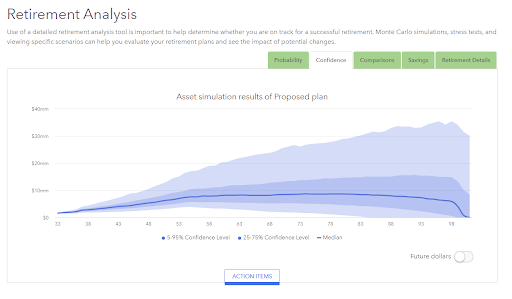

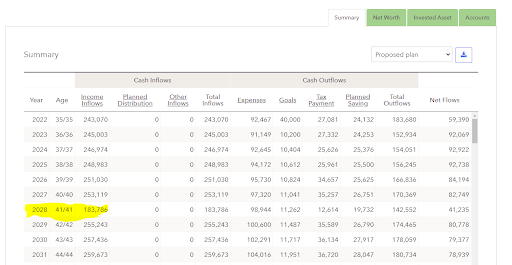

- Long-term impact of your sabbatical

We look at the health of your finances over time, including illustrating the impact a sabbatical can have on your long-term plan, like retirement. This is where we specialize differently than the typical financial planner. Sabbaticals by nature do not follow the traditional work, save, retire pathway.

- Sabbatical goal declaration page

This is a one-page visual to highlight the big goals you want to achieve or hurdles to overcome before you leave so you can feel good about your time away (examples: get a promotion at work, finish my degree, sell all my stuff)

This visual can be used as a motivator while you’re getting ready to take the leap…a quick reminder that you’re working toward bigger things. Click here to read more about how taking a sabbatical can actually boost your motivation at work.

- Vision document for your sabbatical

This is a narrative that helps you explore what you are hoping to achieve during your time away. You’ll envision what you will be doing the day that you leave, what or who you will be when you return, and the questions you will have answers to.

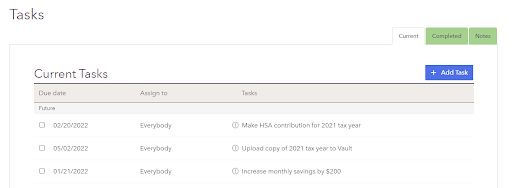

- Action Items for the following quarter

We help you make your sabbatical dream a reality because we are here to keep you accountable. The first phase is accompanied by 3 to 4 actionable steps to take during the next 3 months to help move you closer to your sabbatical goal.

Accountability is important! You’re not alone!

You meet with your planner quarterly to:

- Track progress against your one-page sabbatical goals and the action items you set during the previous meeting. What went well? What didn’t go so well? What obstacles did you encounter? What are new questions that have come up?

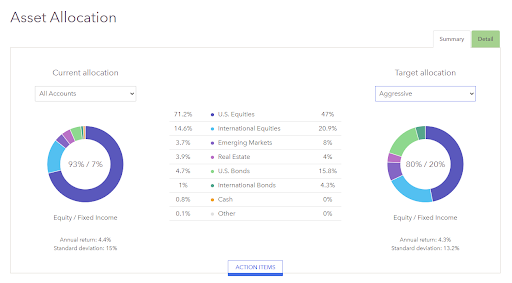

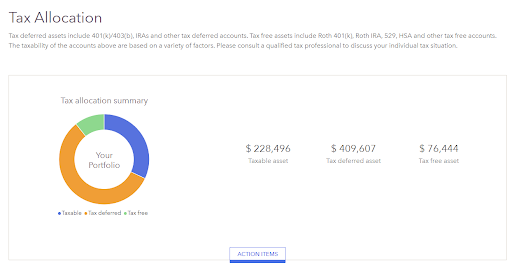

- Identify areas for financial planning optimization (examples: expected low-income years, extra current income that can be saved, assets that can serve as income streams while you’re gone, changes in tax regulations, etc.)

Low-income year (2028) is a year for savings and tax planning opportunities

- Get more specific on both the financial and non-financial aspects of your sabbatical plans – budget, yes, but also travel planning, gear purchases, maintaining connections, etc.

- Highlight some planning gaps that can be planned for (examples: loss of health insurance, savings potential during low-income years, additional insurance and travel risks that can be addressed)

- Prioritize next steps for the following quarter, including things like:

- Strategically saving to specific types of accounts

- Adjusting investment allocations based on your sabbatical timeline

- Working through communication/negotiation with your employer. Learn more about how to talk to your manager here.

Bonus: Along the way we share articles, podcasts, and other resources to help you maintain motivation, inspire creativity in your planning, and to remember you’re not alone in taking a sabbatical

Phase 2: Being Away

Now that you are away, the work isn’t done! We still help you with the implementation of the spending, saving, and tax optimization strategies that were planned for in the Getting Ready phase.

What to expect from phase 2?

- A final prep meeting to sort through the many last-minute details

- Ensuring access to funds for spending

- Planning for any obligations that will continue at home

- Identifying any final steps to take at home that will enable you to do what you plan on your sabbatical

- Potential transition to Investment Advisory client so we can maintain appropriate investment risk and execute the tax-planning strategies listed below on your behalf (let’s be real, you’ll be enjoying your time away)

- Ongoing review of your financial plan and correspondence around applicable tax-planning strategies, including:

- Accounting for any income earned while away

- Roth conversions in low-income years

- Strategies for employer stock plans (RSUs, ISOs)

- HSA reimbursements if that was part of the plan

- Navigating any unanticipated changes (or derailments) of plans

But on top of numbers and financial tips, we are also there to provide regular reminders to reflect on and capture your experiences so you have a portfolio of memories to go back to when you return from sabbatical.

And if you have a question, we’re just a meeting away!

Phase 3: Returning Home

Returning home isn’t what you want to think of when you start planning your sabbatical but it is an important phase to plan ahead to avoid any bad surprises!

We help you figure out this phase with conversations to prepare you for a smooth transition home – financially, personally, and professionally

What to expect from phase 3?

- Preparing for re-entry into the workforce – whether it’s back to the same job/company or doing something totally different, thinking through:

- Financial implications of different career path options

- Points of negotiation for your next job role

- How to translate your sabbatical experience into resume language

- Helping with the overall transition by:

- Working through potential financial obstacles from being away – mortgage approval, car insurance coverage, re-accumulating day to day items

- Ensuring an adequate cash cushion to provide time for you to rebuild your daily life

- Helping you figure out how to share your experience with others, both personally and professionally

Once you’re back, we will have a “Welcome Back” meeting to review your updated financial plan and determine the next steps for our engagement.

This includes:

- Reviewing tax planning strategies to date

- Incorporating any post-sabbatical changes to your money mindset

- Accounting for any updates to health, overall goals, and potential future sabbaticals (we often see that those who do it once are interested in doing it again someday!)

If you want to make your sabbatical dream a reality, we’re here to help and support you every step of the way! Since we have both taken sabbaticals ourselves, we understand what it means to leave everything behind! Living in a new country and meeting new people is surely exciting but it is also scary. With the right planning, we can make the process not only doable but also much smoother and ensure you that you will thrive before, during, and after!

Do you want this

Let’s make your sabbatical an intentional part of your life and your career. We can’t wait to hear more about your dreams and goals. Contact us now for more information! Schedule a discovery call now or send us an email at clientservices@middletonand.co

Like this article? Make sure to Pin It so you can go back to it later!