Each year you get to decide your health coverage for the following calendar year.

If you’ve determined that a high-deductible health plan (HDHP) is a good fit for you and your family, you may be eligible to fund a Health Savings Account (HSA).

We’re big fans of Health Savings Accounts (HSAs) because they can be a beneficial tool while planning your sabbatical too!

Note: keep in mind that the most important decision factor when selecting a health insurance plan is whether the plan meets your family’s medical needs.

Why are HSAs so cool, you ask? The triple tax benefit!

If your high-deductible health plan is HSA-eligible, awesome! That makes you eligible to contribute to the only account type that has triple tax benefits:

- It is tax-deductible in the year you make the contribution

- It grows tax-free (pro tip: remember to invest the money in a risk appropriate portfolio once you’ve funded the account)

- It allows for tax-free withdrawals as long as you reimburse yourself for qualified medical expenses or are age 65 or older

Yes, we know, we’re totally nerding out here, but we consider the HSA even cooler than the Roth IRA (which you may have already guessed…we are big fans of as well!)

Why? Well, the money in an HSA rolls over year to year, which means that it isn’t a use-it-or-lose-it account like Flexible Spending Accounts (FSAs) or Health Reimbursement Accounts (HRAs).

Plus, you can keep the account even after you leave your job or change health coverage. You may not be able to contribute every year, but you never lose the money you’ve already put in.

Aaaaaaand there is no income threshold for contributing! Meaning that as long as you have an HSA-eligible high deductible health plan, you’re able to contribute! This is great for high-income earners who are looking for ways to put aside savings in smart ways.

Check your plan details to see if your HDHP is HSA-eligible.

Funding your sabbatical with the Shoebox Strategy

If you are leaving the country and/or your healthcare coverage will change when you go on sabbatical, you may decide to pull forward planned medical, dental, and vision expenses before your trip…Think Lasik, braces, an extra pair of prescription glasses, etc.

Check out the full list of qualified medical expenses. You might be surprised to find that some of the reimbursable expenses are things you’ve been paying out of pocket anyways. Make sure to keep your receipts – we’ll tell you why!

The Shoebox Strategy entails paying for those medical costs out of pocket instead of taking funds out of your investments in your HSA. This allows the investments in the account to continue to grow tax-free (remember, this is the only account type that has the triple tax benefit and compounding is our friend in the investment world).

If you need funds during your sabbatical, you can review your receipts for previous medical costs you paid out of pocket and reimburse yourself from your HSA, even if the expense was from any prior year.

This strategy helps you take advantage of the tax-free growth of the HSA, and provides flexibility if you need to take withdrawals later on. And even cooler – you can use the reimbursed funds on anything you want!

In other words, your HSA could be treated as an emergency fund while on your sabbatical, preventing you from dipping into your retirement accounts in an emergency (which has penalties for early withdrawals). Or you can build your sabbatical plan to include your HSA funds as your primary source of income while away – each strategy is unique to the person.

Key Takeaways

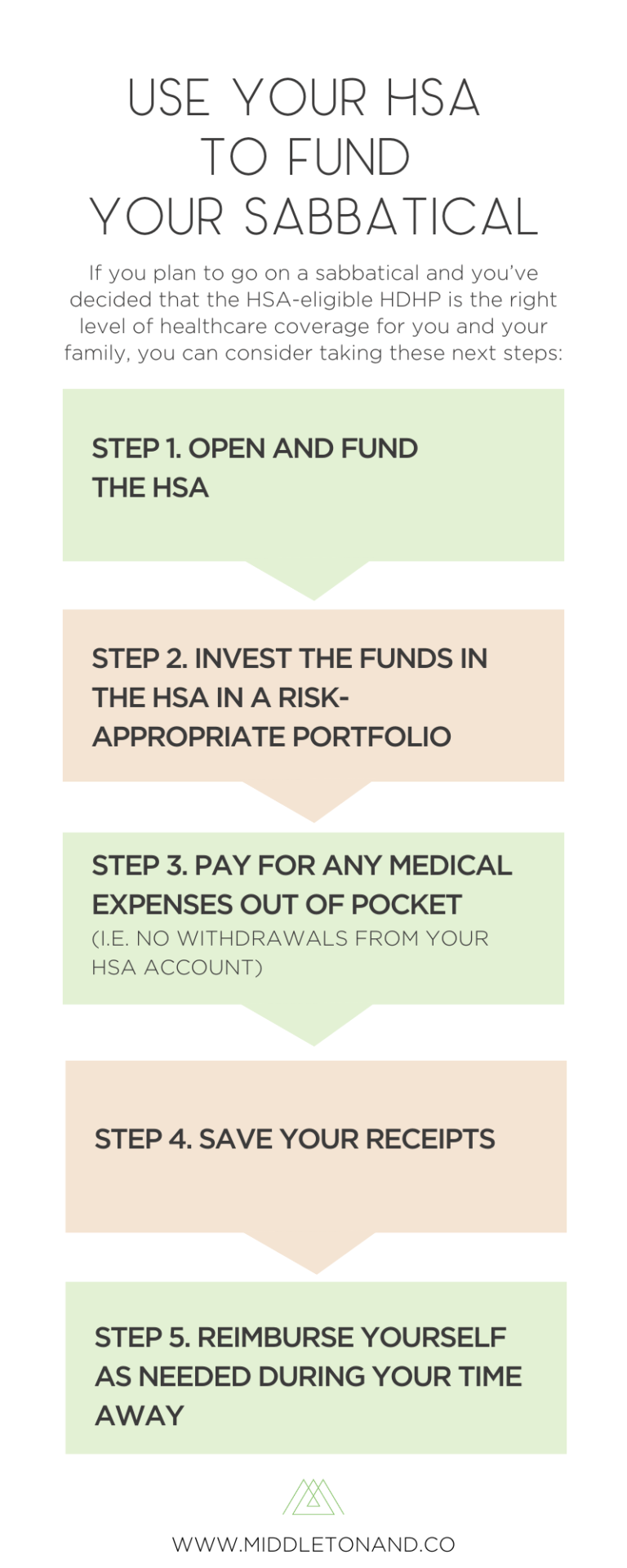

If you plan to go on a sabbatical and you’ve decided that the HSA-eligible HDHP is the right level of healthcare coverage for you and your family, you can consider taking these next steps:

- Open and fund the HSA

- Invest the funds in the HSA in a risk-appropriate portfolio

- Pay for any medical expenses out of pocket (i.e. no withdrawals from your HSA account)

- Save your receipts

- Reimburse yourself as needed during your time away

Contact us if you want help strategizing how your HSA account fits into funding your sabbatical dream.

Like this article? Make sure to Pin It so you can go back to it later!